What is a Multi-car Insurance Policy?

And can it save me money on my car insurance premium?

And can it save me money on my car insurance premium?

When you buy a car insurance policy, there are plenty of ways to find the best coverage and fairest price.

The ability to include multiple cars on a single policy can make your life easier by keeping all of your coverage in one place. And when you sign up with Lemonade Car and include more than one car on a single policy, you automatically become eligible for savings.

Including multiple cars on the same policy is easy and is a simple way to keep you and your loved ones protected without breaking the bank. Let’s take a spin through what it means to be a policyholder with multiple cars to cover.

Rather than having separate policies for each car you own, a multi-car insurance policy lets you cover more than one car on a single policy. Each car is listed under the same policy and policyholder, but some of the specific coverages for each vehicle are customizable.

Signing up for a multi-car policy is really no different than for a single-car policy (except the fact that it includes more than one car). It’s this simple—when you’re looking for quotes with different car insurance companies, you add all the cars that you want to cover. The number of cars that you can cover on a single policy will depend on the state that you live in and your car insurer.

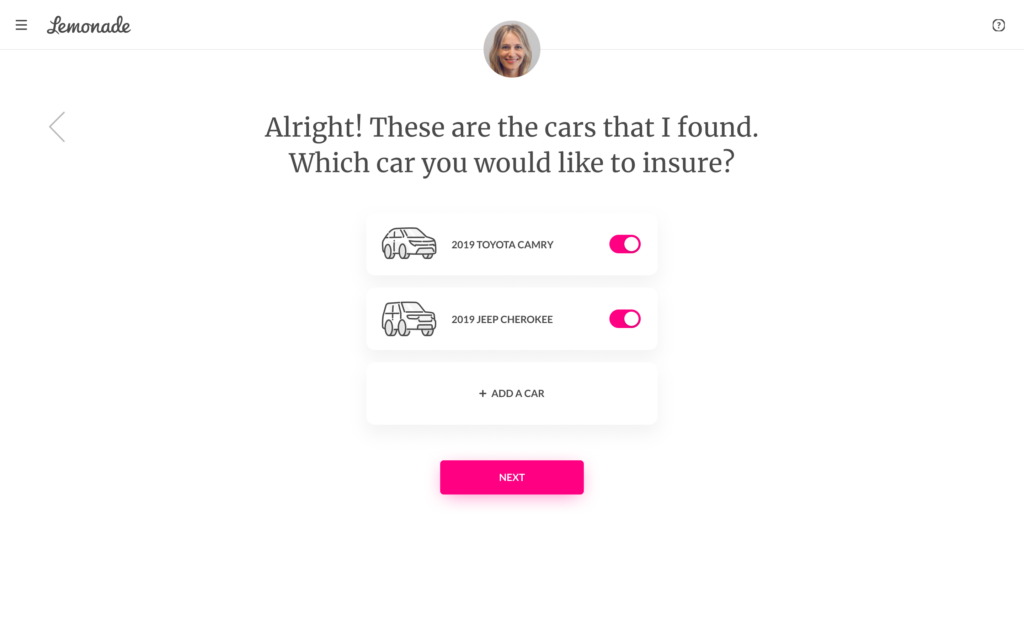

When you buy a Lemonade Car policy, you can easily add each car that you’d like to include on your policy. Our records may automatically identify the cars in your household, but you can also add cars manually that don’t already appear—like a new car that you’ve recently purchased and registered.

It’s important to make sure that all cars that you’d like to include in your policy are toggled so that they’re highlighted in pink.

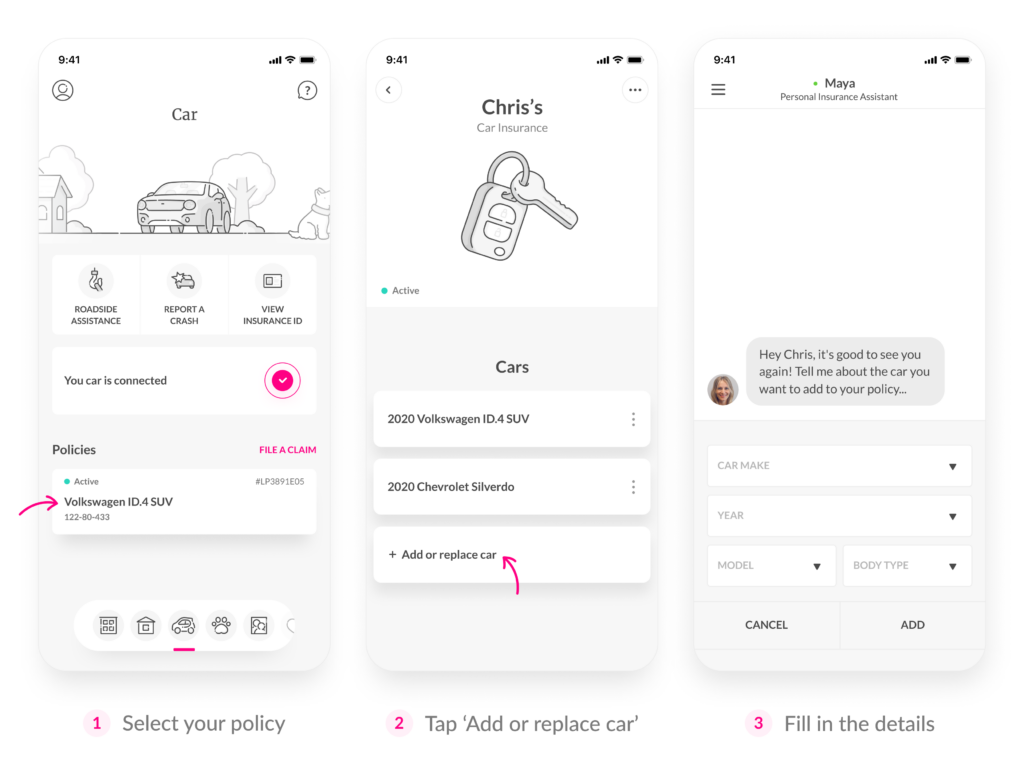

Maybe you just traded in your older car for a newer model, or bought a car for your teenager once they earned their full-fledged driver’s license. As cars come and go from your life, you can easily adjust the details mid-term on the Lemonade app. And when you replace a car on your policy, it’s easy to set up the plug-in device in your new car using the Lemonade app (usually with the same nifty device as your old car).

Keep in mind: Adding or replacing cars on your policy can impact your policy price.

For sure. When you add a second car (or more) to your Lemonade Car policy, you become eligible for savings on your premium.

Once you buy your Lemonade Car policy, the policy document itself will give you a price breakdown for each car that’s on your policy.

Besides the savings you could get from having a multi-car insurance policy, there are additional conveniences to having a single insurance provider and policy to cover your needs.

Here are a few of the many perks:

On a single Lemonade Car policy you can include up to 4 cars. Each car included on your multi-car policy must be registered and kept in the same state and registered under your or your spouse’s name.

Curious if your personal situation makes you eligible for a multi-car policy? Here are a few common scenarios.

What if you’re a family of 4 that wants to share a car insurance policy—and each of you has your own car and a valid driver’s license or learner’s permit?

It can get a little complicated depending on the specifics. Let’s say your teenager who lives with you just got a new Toyota Corolla registered in their name for their Sweet 16. To include that car on your policy, you’d just have to have the car re-registered in your name and/or your spouse’s name.

Meanwhile, if you decided to buy your out-of-state college student a used Subaru in your name, it wouldn’t be eligible for inclusion on your multi-car policy since it would be stored and driven in a different state.

If you’re looking to save on your car insurance premium by sharing a multi-car policy with your significant other or college roommates… it’s probably more trouble than it’s worth.

Unless each of the cars that you’re looking to jointly cover are registered under the same name—which would be pretty uncommon—you’ll have to stick to your own individual policies.

It is possible, though, to include additional drivers on your policy for a single vehicle. At Lemonade Car you can cover up to 7 drivers on your policy. So if your buddies regularly borrow your Tesla for errands or weekend trips, they should be added to your policy.

If you drive a company car, it’s registered under the company’s name and not yours. So, that car wouldn’t be eligible for coverage under your multi-car insurance policy.

Although a leased car is not technically “yours,” if it’s leased under your name you could include it on your multi-car insurance policy.

Even though a multi-car insurance policy includes each car under the same policy, at Lemonade Car it’s easy to tailor each car’s individual insurance coverages.

All cars on your multi-car policy will have to carry the same liability insurance—the bare minimum car insurance that covers damage you may cause to other drivers and their property. But beyond that, you can add extra coverages to specific vehicles, according to your tastes and needs.

Let’s say you have a multi-car Lemonade Car policy that covers three vehicles: A 2008 Honda Civic, a 2015 Prius, and a 2020 Toyota Corolla.

Maybe you’re less concerned about the Civic, which you don’t drive that often, and so you only add liability insurance for that vehicle. No problem. You’re still able to customize coverages for your other cars as you see fit.

That means you could hook the Prius and the Toyota Corolla up with all the bells and whistles to give them “full coverage.” Just don’t let the name fool you—full coverage doesn’t mean you’re covered for everything, nor does it guarantee your claim will be approved.

If you add on coverages like comprehensive and collision insurance (which are separate, but equally important additions) with Lemonade Car, you have the option to go the extra mile to protect your cars with temporary transportation coverage and glass and windshield coverage. You can even customize the deductible you want for each type of coverage on each car.

One important caveat here: There are certain add-on coverages that must be applied to all vehicles on a multi-car policy, if you choose to add them at all. These include things like coverages for bodily injury, medical payments, property damage, and uninsured drivers.

At Lemonade Car, the way you drive matters. Your monthly mileage helps determine your premium—so the less you drive, the more you’ll save.

We’ll send you a device to plug into your car’s OBD-II port, which lets us track your mileage with precision—in addition to other benefits, like helping us retrieve your car if it gets stolen.

Driving with the device is required, and you can learn more about how it works here.

If you have a multi-car policy, we’ll send you a distinct device for each car that you cover, and walk you through the easy installation.

Glad you asked. We’re a bit biased, but… When you buy a multi-car insurance policy with Lemonade Car, you can enjoy the conveniences of having up to 4 cars covered in one place, with all the savings that entails.

But there are a lot of other ways you can lower your car insurance costs even more with a Lemonade Car policy.

For example, you can save on each of your premiums when you bundle with other Lemonade policies like renters, homeowners, pet health, or life insurance.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them.represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.