Loan Estimate

A loan estimate is a three-page document you receive from your lender after applying for a mortgage, which breaks down the costs.

A loan estimate is a three-page document you receive from your lender after applying for a mortgage, which breaks down the costs.

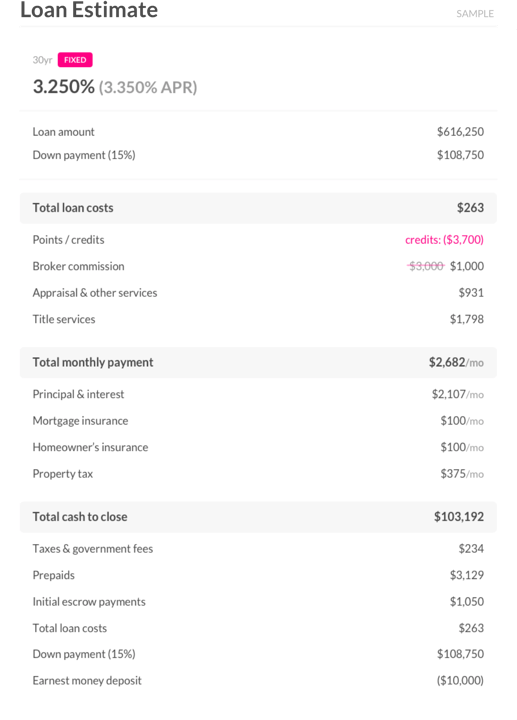

A loan estimate is a three-page document you receive from your lender after applying for a mortgage. The loan estimate breaks down your costs, including your down payment, taxes, insurance, and lender fees, and lumps it into one figure called “cash-to-close”.

Three business days after applying for a mortgage, or home loan, your lender will provide you with a document called a loan estimate. The loan estimate contains the terms you’ll be presented with if you accept the loan – but it doesn’t mean your application is accepted yet. The document also includes your estimated interest rate, monthly payment, and total closing costs.

The loan estimate document tells you how much you should expect to pay on taxes and insurance, and how the interest rate and payments on your mortgage may change in the future. Each form looks exactly the same, which makes it easy to compare lenders’ estimates.

A loan estimate shouldn’t be confused with a closing disclosure, although they’re similar. A closing disclosure is a five-page document you’ll receive from your lender at least three business days before you close on your loan. You’ll want to compare your closing disclosure against your loan estimate to check the final terms and costs.

There are certain costs in your loan estimate that can change, like interest rate. However, fees paid to the lender, and transfer taxes, won’t. If some of your costs do change, you’ll be presented with a revised loan estimate from your lender. Your loan estimate clearly lists whether each amount can increase after closing.

Your loan estimate is three pages long. The first page lists the most important information, like the terms of your loan and closing costs. The second page shows your loan costs and origination charges, such as lender fees, aka “application fee” or “underwriting fee.” These are negotiable, so compare them with other lenders when mortgage shopping.

Page three of your estimate lists the ‘percent paid in interest,’ ‘APR’ (annual percentage rate) and ‘total cost in five years’- (total charges you’ll incur). You can see a sample of page three on a loan estimate below.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.