Whether you’re stepping into your first apartment or simply updating your current living situation, the world of renters insurance can be a bit overwhelming. But fear not! We’re here to break down one of the most important documents you’ll encounter—the renters insurance declarations page.

We’re going to take an up close and personal look at a renters insurance declarations page, so you can fully understand your policy, your premium, and your coverage. By the end, you’ll be navigating your insurance with the confidence of a seasoned renter.

- A renters insurance declarations page, often called a “dec page,” is a critical document that outlines the key details of your renters insurance policy

- The dec page offers a quick overview of your coverage, making it easier to understand what you’re protected against

- It includes information about your personal property and liability coverage, along with any endorsements or additional coverages, helping you see at a glance how your insurance meets your needs

Why do you need a renters insurance declaration page?

The primary purpose of your renters insurance declarations page is to provide proof of coverage. Whether you’re renting an apartment or a house, your landlord may require this document to ensure that you have adequate insurance coverage. The document verifies that your personal property is protected, which is a standard requirement for most rental agreements.

How do you get a renters insurance declarations page?

Getting your declarations page from your insurance company should be pretty straightforward, but how to go about it depends on your insurer.

Here are some common ways to get it:

Direct from your insurance provider

When you initially purchase renters insurance, your insurance company will typically send you a copy of your declarations page. This might be delivered via mail or email, depending on your preference and the provider’s standard procedures. Keep this as part of your important documents.

Online access

Most modern insurance companies offer online access to your policy documents. You can log into your account via their website or mobile app and view, download, or print your declarations page. This method is not only convenient but also ensures you always have access to the latest version of your policy.

If you have a Lemonade renters insurance policy, you can easily grab your declarations page right on the Lemonade app.

Through your insurance agent

Your insurance agent can provide you with a copy of your declarations page. They can walk you through the details, answer any questions, and help make sure you have a full understanding of your policy.

What’s included in a renters insurance declarations page, and how can I read it?

Your declarations page is the summary of your coverage under your renters insurance policy. It’s fairly easy to read and includes important information regarding things like your coverage, coverage limits, deductibles, who’s covered, and more.

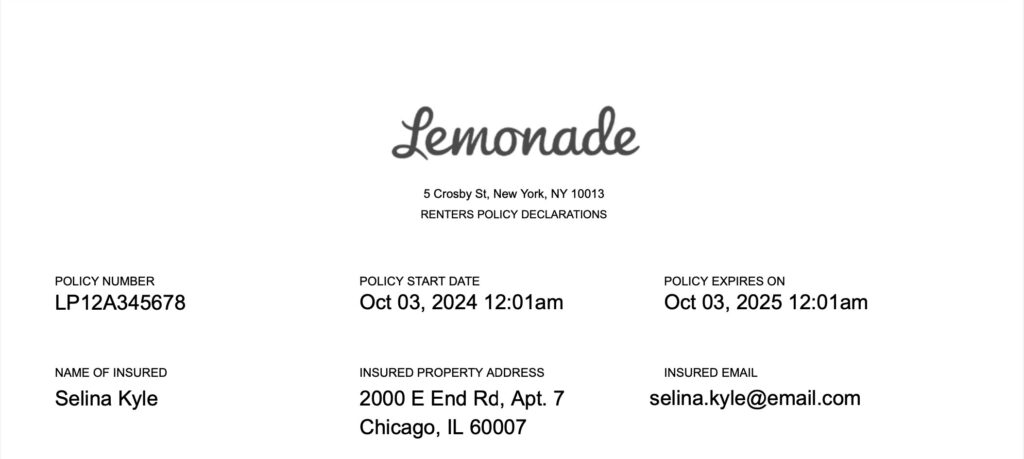

Let’s break it down with an example of a Lemonade renters insurance declarations page.

The basics

When reading through your declarations page, this section is where you should start. The top part of the first page of your renters insurance declarations page will have some basic information about you and your policy, including:

- Your name (or the “named insured”)

- Others covered under the policy (referred to as “additional insureds”, often spouses or relatives under 21 years old)

- Your policy number (a unique identifier for your insurance policy)

- Your physical address (the property insured under the policy)

- Your email address

- When the policy starts (the policy’s “effective date”)

- When your policy ends (the policy’s “expiration date”)

This info might seem like a no-brainer, but be sure to thoroughly check that everything is accurate. If you spot a mistake, or if your contact information changes, be sure to get in touch with your insurance company to nip any potential issues in the bud.

If you’re a Lemonade renters insurance policyholder, you can often update your policy information online or via your Lemonade mobile app.

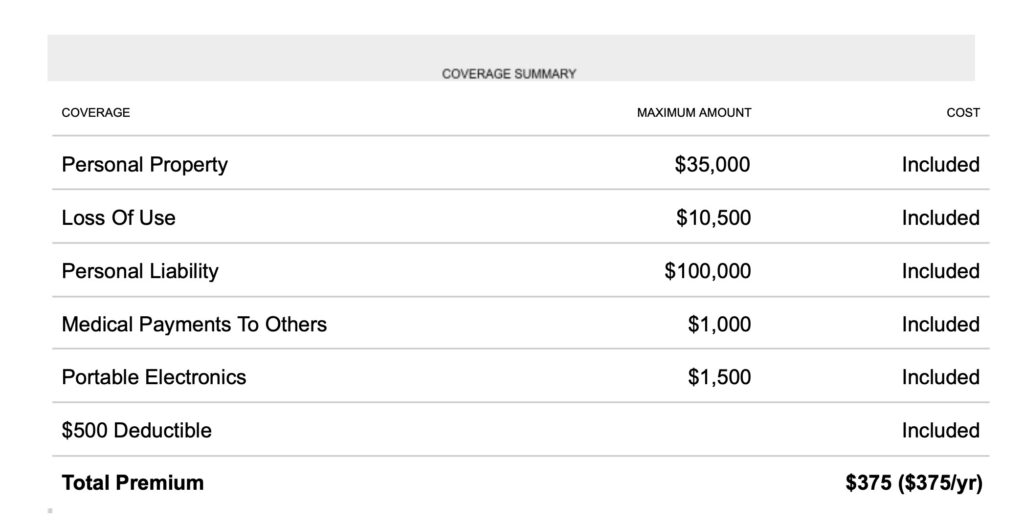

Coverage summary

Now for the real meat of your policy.

On your renters insurance declarations page’s coverage summary section, you’ll see several different amounts connected to your coverage broken down for you. It’s important to note, that in the coverage summary section of your declarations page, the formatting may vary slightly depending on your insurer.

First let’s clear up some declarations page terminology:

- Maximum amount: The numbers listed in this column represent the limit to your coverage. Let’s say you have a $35,000 limit for personal property, but damage to your personal property will cost you $45,000 to repair. If your insurance company approves your claim, you’ll only get the $35,000.

Here’s what you’ll see listed on your coverage summary, so you know what to expect when you decide on your coverage or file a claim:

- Personal property: This covers your stuff. If your bike gets stolen when it’s chained in front of a coffee shop, it’s covered with renters insurance. If your apartment is broken into and your brand new 65-inch flat-screen TV is stolen, that’s covered too. However, your insurance company will only provide coverage up to your personal property coverage limit, and the loss or damage to your personal property is due to a covered loss, such as theft. Here, the personal property coverage limit for our hypothetical policyholder Selina Kyle is $35,000.

- Loss of use: If your rental home or apartment is damaged and becomes unlivable due to a covered loss under your policy, loss of use coverage will pay for things like hotel stays, takeout, and laundry while you wait for the damage to your home to be fixed. In this example, Selina has a loss of use coverage limit of $10,500, which is the maximum amount the insurance company will pay for this coverage.

- Personal liability: This coverage comes in handy if you’re in a legal bind. If someone who does not reside in your home is injured on your rental property and it’s your fault, or if you or anyone else on your policy damages someone else’s property, this coverage can help cover the costs. Personal liability coverage can also come in handy to cover your legal fees if you’re responsible for an accident. Above, you can see that Selina’s coverage limit for personal liability in this example is $100,000.

- Medical payments to others: If someone who does not reside in your home is injured on your property, this will cover the medical expenses up to $1,000, in the example above, regardless of fault.

- Portable electronics: This coverage provides protection against loss or damage to items such as laptops and smartphones. The coverage limit for Selina is $1,500 for portable electronics. It’s important to note that this limit is not a separate coverage limit on the policy, but a special limit under your personal property coverage.

- Deductible: Every time you file a claim, the deductible determines how much you pay out of pocket before your insurance coverage kicks in. The higher your deductible, the more you save on your monthly premium. This is why you’ll see a “-X” in the cost column of policies with higher deductibles–that’s how much you save by choosing a higher deductible. The deductible in the above example is $500.

- Total Premium: This is the amount you pay for renters insurance coverage. Selina Kyle’s total premium is $375 per year.

Page #2- Extra Coverages

Your personal property coverage is an amount you select when you purchase your renters insurance policy. However, things like jewelry, artwork, musical instruments, and cameras are typically subject to their own special limits under your personal property coverage.

Jewelry, for example, has a $1,500 sublimit for losses due to theft. So even if you chose a $35,000 amount for your personal property coverage, a base policy would only cover jewelry theft up to $1,500 (after you’ve met your deductible).

This is where Lemonade’s Extra Coverage comes in. By adding Extra Coverage, you can increase the coverage limits for your valuables for an additional premium.

Here, on October 1, 2024, the hypothetical customer Selina Kyle added an engagement ring to the policy at a value of $11,500 and an Electric Keyboard at a value of $5,000 all for an additional premium of $203.00 per year.

You can add certain big-ticket items to your Extra Coverage; pay a little extra on your monthly premium, and if an item listed under your Extra Coverage is lost, stolen, or damaged, you can file a claim and get money back without paying a deductible. However, it’s important to note damage occurring from normal “wear and tear”, would not be covered.

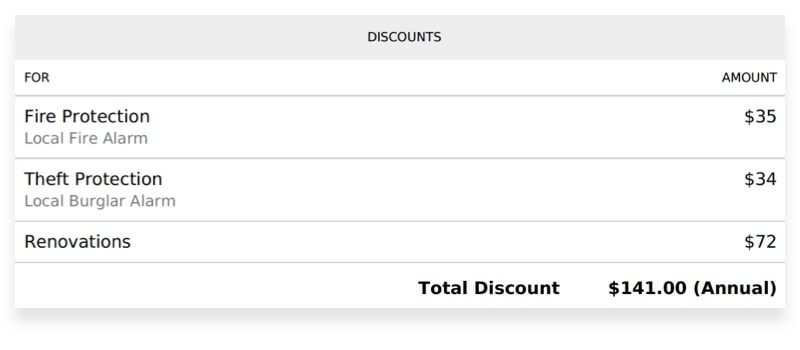

Discounts

Who doesn’t love a discount? If you have certain safety measures in your rental home, you can save money on your policy. Having features like a smoke detector, fire alarm, or burglar alarm could help you reduce your monthly premium.

In the example above, the user has discounts for fire protection by having a fire alarm, a discount for theft protection by having a burglar alarm, and a discount for renovations. These discounts save this hypothetical customer $141 annually on their renters insurance.

Keep in mind that the discounts will vary by policy.

What’s not included in a renters insurance declaration page?

Your declarations page is useful in giving you an overview of what your policy covers, but it doesn’t contain everything you may want to know. Here are some things that you won’t be able to find on your declarations page.

Exclusions

Your renters insurance declarations page will not list specific exclusions. These are the events or types of damage that your policy does not cover, such as certain natural disasters like earthquakes, or normal wear and tear.

There are two sets of exclusions in a renters insurance policy. The first set of exclusions is for your property coverage, which includes:

- Coverage C – Personal Property

- Coverage D – Loss of Use

- Additional Coverages (aka Extra Coverage)

You will find these coverages in Section I of your policy, where there will be a dedicated exclusions section.

The other set of exclusions will be found in Section II of your policy, which is for your liability coverages including:

- Coverage E – Personal Liability

- Coverage F – Medical Payments to Others

Detailed policy conditions

While the dec page provides an overview of the types of coverage you have on your policy, and how much you’re covered for, it doesn’t delve into the specifics of each coverage type, such as what events will be covered.

In order to find detailed information on all of your coverages, you’ll need to refer to Section I of your policy, for property coverages, and Section II of your policy, for liability coverages.

The claims process

The declaration page won’t outline the claims process or provide guidance on filing an insurance claim. In both Sections I and II, you’ll find a subsection called Duties after Loss, for property coverage, and Duties after “Occurrence”, for liability coverage.

Both sections contain important information on the steps you need to take when filing a renters insurance claim in the unfortunate event that you experience a loss, including how long you have to report the loss or occurrence to your insurer.

Wondering how to navigate your policy exclusions, conditions, and the claims process? Your declarations page will list all of the documents included in the policy packet. It’s your quick guide to all the info you need about your policy.

Before we go…

When your insurer sends over your insurance policy, you might be overwhelmed by the pages of complicated text outlining the legal and technical elements of your policy. Of course, here at Lemonade, we try to keep things as straightforward as possible.

Think of your renters insurance declarations page as a TL;DR of your policy: an outline of the practical, digestible details of your coverage. Once you get a handle on all the information on your declarations page, you can be confident that you fully understand your coverage.

And we’d be pretty remiss if we didn’t say that Lemonade offers renters insurance, and we think it’s a pretty great deal. Click below to get started on your quote!

FAQs

How can I update my renters insurance declaration page if my contact details change?

You can update your information by contacting your insurance provider directly or through their online portal or app if available. It’s important to keep your contact information current to avoid any issues with your coverage.

Do I need to know my policy number?

Yes, your policy number is a unique identifier for your insurance policy. Keep it handy as you’ll need it for any communications with your insurer or to file a claim.

How often should I review my renters insurance declaration page?

It’s a good idea to review your declaration page annually or whenever there is a significant change in your living situation or personal property, such as purchasing an engagement or wedding ring. This ensures your coverage remains adequate for your needs.

What should I do if I notice an error on my declarations page?

Contact your insurance provider immediately to correct any errors you spot on your declarations page. Accurate details are vital for proper coverage and claim processing.

Is a declaration page the same as proof of insurance?

Yes, a declaration page is a form of proof of insurance, as it outlines the key details of your renters insurance policy, including coverage limits and effective dates.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.