What is Renters Insurance and How Does it Work?

Breaking down the ins and outs of renters insurance.

Breaking down the ins and outs of renters insurance.

Renters insurance is a type of protection designed specifically for people who rent their homes or apartments. It’s like having a financial safety net that helps you recover from unexpected events.

Imagine coming home to find that your apartment has been broken into or a pipe has burst, soaking your furniture, collectibles, and electronics. Renters insurance steps in to assist with the expenses of replacing your personal belongings or repairing the damage.

Beyond protecting your stuff, renters insurance can also help if someone gets injured at your place and decides to sue you for medical expenses or other damages.

Is renters insurance required? Are you covered outside of your home? Let’s break it down.

Renters insurance is a safeguard for tenants, offering you financial help if certain unfortunate things happen to you or your stuff.

Think of your policy like a safety net that’ll kick in and help if there’s loss or damage from or due to designated “perils,” which include theft, fire, vandalism, certain types of water damage, and more, specifically listed in your policy.

Also, if your entire apartment is damaged to the point where you’re unable to stay there, and the damage is caused by a covered peril, renters insurance can typically cover you for the nights you might need to spend at a hotel as well as other additional living expenses.

And if someone else is injured at your place while visiting, it can even help with their possible medical or legal fees.

A renters insurance policy provides financial reimbursement if you lose or damage your personal belongings due to an event that is covered under your policy.

If a covered event occurs and there is damage to your personal property, you will file a claim with your insurance company for reimbursement.

Should you file a claim, your renters insurance company may compensate you for any covered losses—minus your deductible, which is the amount you agree to pay out-of-pocket before you receive compensation from your insurer, and up to the limits specified in your policy.

When you sign up with Lemonade you’ll be able to pick a deductible between $250 and $2,500. A lower deductible will equal a higher monthly premium, since you’ll owe less out-of-pocket in the event of a covered claim.

There are two different coverage types when it comes to reimbursement under your renters insurance policy:

If your policy covers you for the replacement cost of your items, your insurer will reimburse you the amount of money to replace, or repair, your item with a similar item available on today’s market respecting the quality, make, model, etc.

If your policy covers you for the actual cash value of your items, you will be reimbursed how much your item would go for today (same make and model), minus depreciation for things like wear and tear and obsolescence. Essentially, you will be paid what your item is worth in today’s market, and not what you initially paid for the item.

In exchange for the protection renters insurance provides, you’ll make monthly or yearly payments (known as your ‘premium’) to your insurance company.

Your premium depends on a range of factors, like where you live, the amount of coverage you purchase, your claims history, and more.

For a deep dive into all things covered under a renters insurance policy, check out What Does Renters Insurance Cover?

The short answer is no, renters insurance is not legally required by any state or federal laws. However, that doesn’t mean you should skip getting it altogether. Many landlords and property management companies require tenants to have a renters insurance policy as part of the lease agreement.

This requirement helps protect the landlord’s investment by ensuring tenants can cover damages to their personal property or any potential liability issues. It also helps safeguard their rental property by making sure tenants can handle any covered loss, such as theft, water damage, or vandalism, without the need for landlord insurance to come into play.

Even if your landlord doesn’t require it, having renters insurance is a smart move. It provides a financial safety net in case something goes wrong. Without it, you could be left paying out of pocket to replace your personal items or cover legal expenses if someone gets injured.

In a nutshell, while you’re not legally obligated to have renters insurance, it’s highly recommended for the peace of mind and financial protection it offers.

Yes, renters insurance coverage can extend beyond your home! One of the lesser-known perks of a renters insurance policy is that it often covers personal property outside of your rental unit.

For instance, if your personal belongings are stolen while you’re traveling, in the US or abroad, your renters insurance can help cover the cost of replacing them. This coverage typically includes items like laptops, cameras, and even clothing.

Additionally, renters insurance can offer liability coverage in situations that happen away from your home. If you’re found responsible for accidentally injuring someone or damaging their property, your renters insurance policy might help cover the legal fees and medical bills, even if the incident occurs off your property. This kind of personal liability coverage is invaluable whether you’re on a trip or just out and about.

So, whether you’re on a luxurious vacation or just running errands around town, renters insurance can provide a safety net for both your personal belongings and your personal liability, making it a versatile and valuable coverage option.

If your landlord or property management company requires you to have renters insurance, your renters insurance policy will need to go into effect on your move-in date. Most landlords will not provide you with keys to your new rental unit without proof of active renters insurance coverage.

Your policy’s effective date is when your insurance coverage kicks in, safeguarding your personal property and offering liability coverage. It’s important to note that most insurance companies will not allow your policy to become active on the same day of purchase.

For example, at Lemonade, the earliest your policy can become active is at 12:01 AM the day after purchase. However, you don’t have to wait until your move-in date, as you can select a future date for your policy to become active. This means it’s convenient to get this step out of the way as quickly as possible to avoid any hiccups in moving into your new place.

Luckily, getting a quote and purchasing a policy with an insurance company like Lemonade is a breeze! You can get a renters insurance quote quickly and ensure all your valuables are protected, providing you with peace of mind and a smooth move-in process.

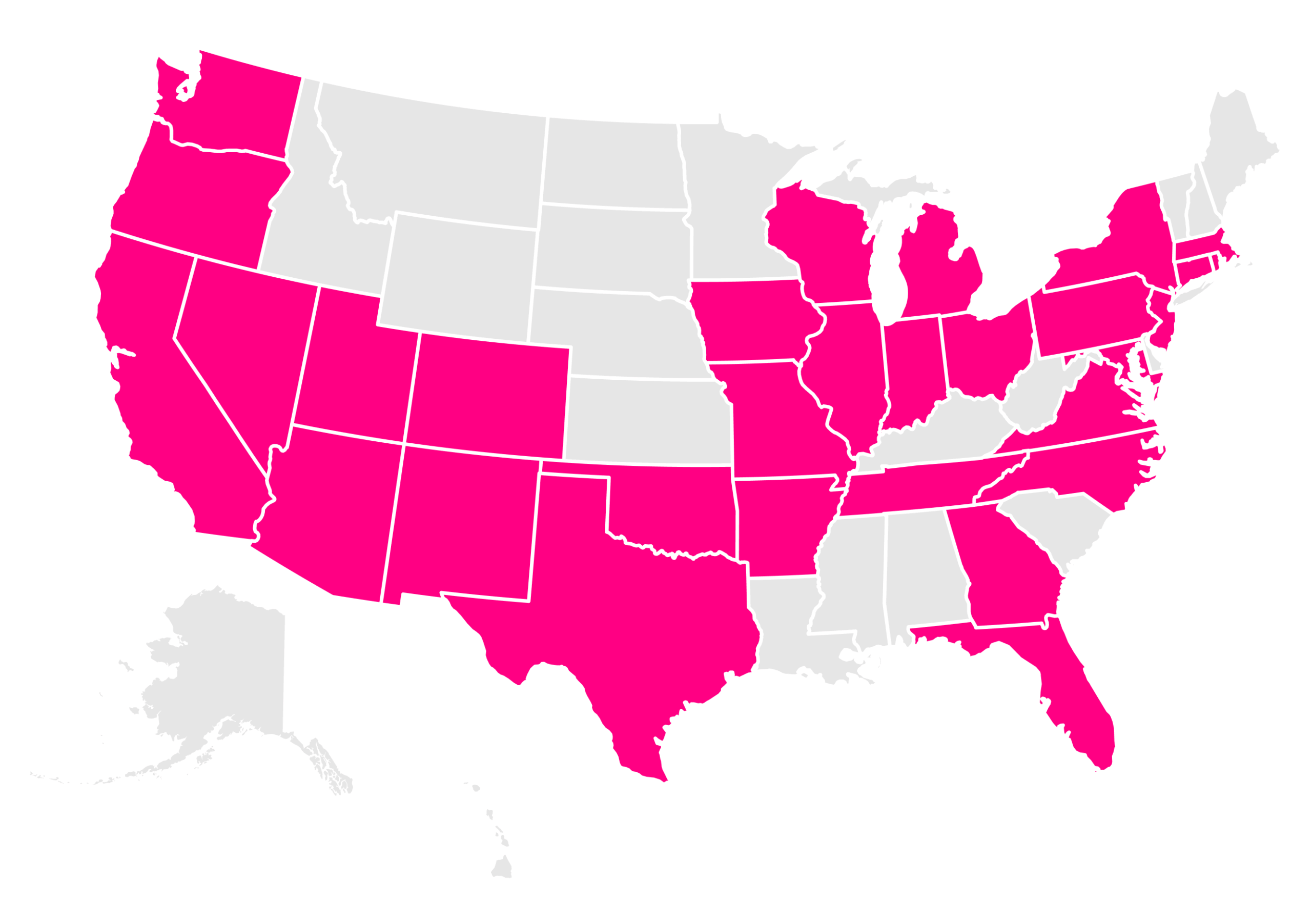

These are the states we currently offer renters insurance in:

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

Still not sure what amount of coverage is right for you? Check out our easy guide to how much renters insurance you need.

The short answer is no. A renters policy will cover your personal belongings, but will not provide coverage for your roommate’s stuff. While your landlord may only require one roommate to have liability coverage, it’s recommended that each roommate has their own renters policy to ensure their personal belongings are covered. With this being said, significant others can be added to your policy, for an additional premium.

Creating a home inventory is a great way to determine the value of your personal belongings. Documenting your items and their estimated value, can help you choose the right amount of coverage you need and will simplify the claims process.

No, renters insurance primarily offers liability coverage for injuries sustained by guests in your rental unit. For personal medical expenses incurred by you or someone residing with you, you will need health insurance rather than relying on renters insurance.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.