That’s a great question. Your household insurance policy (aka, your renters or homeowners policy) covers losses suffered by everyone living in your home and related to you by marriage, blood, or adoption. That means your children, husband, wife, partner, parents, etc. … you get it.

But household insurance coverage isn’t always straightforward, nor are your relations to everyone in your household. So we’re here to dive a little deeper on this one. If you want a deep dive into homeowners insurance, read our in-depth explainer here.

Your spouse, til’ death do you part… or not!

As long as you’re in a legally binding relationship with your sig other you should be good to go.

But we’re in the 21st century, people. Partnerships in this day and age don’t come one-size-fits-all anymore.

Engaged but not yet tied the knot? Cohabitating? Consciously uncoupled but still living under the same roof? Marriage just isn’t for you?

If you’re not officially married, or in a legally-recognized civil union, your policy will not cover your significant other by default. But no worries – you can add them as an “additional insured” for an extra cost. If you go down this route, just keep in mind that it may be cheaper (and easier) for each of you to get your own insurance policy.

Kids under your own roof and at college

As we mentioned before, your policy automatically covers anyone related to you by blood or adoption, and that means kids! Cut and dried, right? Well…

We all know that with kids, it’s never that easy. Even for those of us who haven’t yet had children remember all of the damage and destruction we left in our wake during our childhood. Sorry, Mom!

Basically, all you need to know is that your renters or homeowners insurance will not cover intentional damage your offspring cause to other people’s stuff (in insurance lingo, this is known as negligence).

Now, let’s talk college. We mentioned before that your policy covers any members of your household who are related to you by blood. So what does that mean for your not-so-young ones who’ve moved out of your place?

Let’s use an example:

You have a 20-year-old in college and another 25-year-old in grad school. As long as they were both living with you before going off to live on campus, your younger child is covered while the older one isn’t.

Why? Renters and homeowners insurance only cover your children away at college under the age of 24. An important condition of this whole college business is if they aren’t in school full-time (as defined by the school), they aren’t covered, regardless of age.

Other relatives

In your typical HO3 or HO4 (home or renters) policy, you’ll see that “Insured” means you and residents of your household who are:

a. Your relatives; or

b. Other people under the age of 21 in your care or in the care of a resident of your household who is your relative

What does this mean? Ideally, anyone outside of your immediate family (read: anyone other than your mom, dad, brother, sister, children, grandparents) should generally seek additional coverage. This isn’t because you feel any less close to them – to the contrary – it’s so that you’ll all have enough protection should bad things happen.

So if you are living with a second cousin or another distant relative, it’s probably better that you each get your own policy. If you’re living with your sister, just make sure you buy enough coverage for all of your (and her) stuff! Also, with two policies, you’ll each have your own renters insurance liability coverage which is important when bad stuff happens.

Do roommates count as household members?

TL;DR – no, they don’t. You won’t be able to add your roommates to your policy. Tell your roomie to get their own policy so they’ll have enough coverage for their stuff.

Living in the city as a young adult or off campus as a student isn’t cheap. Roommates are often a great way to cut costs while still maintaining a nice lifestyle and central location.

That said, while renters insurance might cover some portion of shared items in an apartment, it won’t typically cover your roomie’s stuff. Better that you each get your own policy to make sure each of you has enough coverage for all of your stuff.

Dogs and other animal friends

Your furry BFFs are covered for liability to others at home and while out on walks – but remember, if your dog damages your own stuff, or your apartment, that’s on you.

That said, there are two major exceptions regarding coverage when it comes to your pup.

You’re not covered if:

1. Fido has a history of biting (tracked in city or state databases)

2. Your dog is categorized as a reactive breed

Dogs in the latter category include Pit Bulls, Staffordshire Terriers, Doberman Pinschers, Rottweilers, German Shepherds, Chows, Great Danes, Presa Canarios, Akitas, Alaskan Malamutes, Siberian Huskies, and Wolf-hybrids. We know it’s not fair for you or your dog, but regulation is regulation.

FYI: the above exceptions do not apply if the dog is certified as a Seeing Guide Dog, Hearing Dog, or is Trained to Assist the Physically Disabled.

So if your Pit Bull happens to be a Seeing Guide Dog, you’re covered (unless he has a questionable background)!

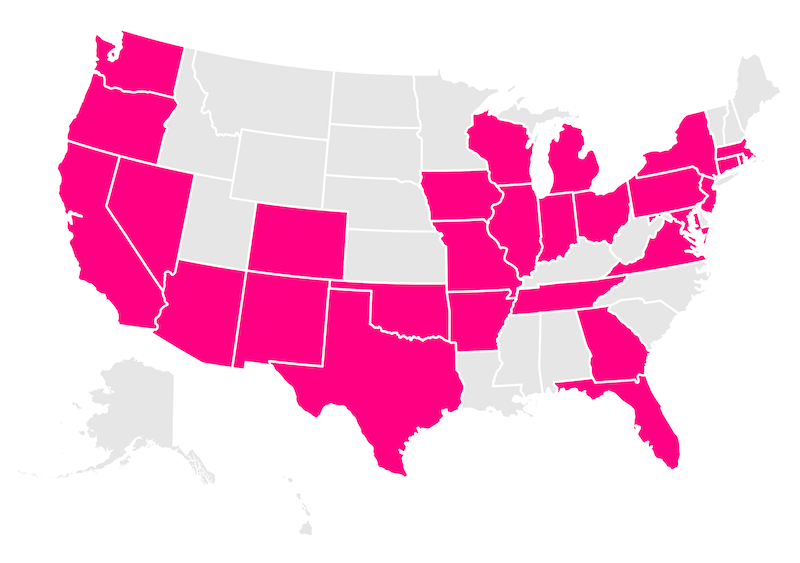

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

Next steps

Who your policy covers isn’t always the most straightforward thing, so we hope we helped clear things up a bit!

If you are in the process of shopping around for a renters or home insurance policy, here are a few other things we can help you with:

- Understanding what is and isn’t covered by renters/homeowners insurance

- Deciding how to choose an insurance deductible

- Thinking about what type of customer service experience you’d like (i.e. do you want to be able to call someone if something happens or you need to update something, or if you’d prefer to do everything in an app)

Already have a Lemonade renters insurance policy? That’s awesome! Then, go ahead and read up on what to do next after buying a renters policy.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.